The final interest rate decisions of 2023 have given precious metals a further price boost today. The US dollar has fallen to a four-month low as markets anticipate 2024 will see rate cuts, pushing gold back above $2,000.

The Federal Reserve have spent previous months pushing back against the idea of rate cuts in 2024, stating that rates would need to be ‘higher for longer’ to bring inflation down to the Fed’s 2% target. With inflation falling however, and the US economy so far proving resilient to higher interest rates, it seems the Fed’s monetary policy committee have turned dovish.

Although the Fed left interest rate unchanged last night as expected, the dot plots from its members (charting expectations for rates in the year ahead) suggested that the Fed itself expects that rates will begin to fall next year. Despite Chairman Jerome Powell cautioning that rates could still rise if needed, markets took the dot plots as the sign they were looking for. Stock markets rose, and the US Dollar Index has dropped 1.2% since last night’s announcement.

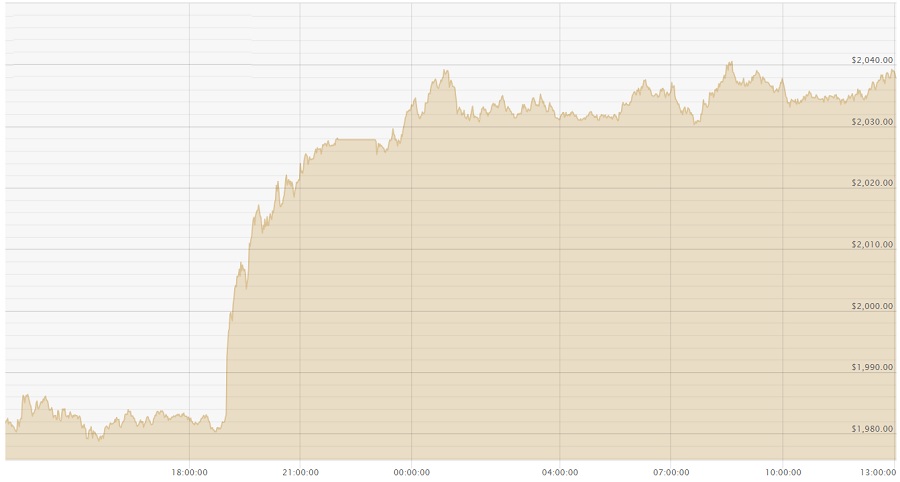

The gold price saw a spike as the Federal Reserve announced their latest rate decision.

Gold gained more than 2.5% as a result, jumping from $1,978 to $2,040 in just a few hours, and has so far stabilised in the $2,030 - $2,040 range. Silver gained over 6% in the same period, climbing from $22.53 to push past $24 per ounce. US rate cuts will be a key driver for gold and silver in 2024, and last night was the clearest indication that such cuts are on their way.

The Bank of England also left UK rates on hold today, but with a more hawkish tone. Three of the committee’s eight members even voted to hike rates up to 5.5% but were outvoted by the other five. The UK is in a very different position to the US, with UK core inflation still at 5.6% in October, and the BoE will likely have to keep rates at current levels further into 2024 than the US.

Thanks to a falling dollar, and the more hawkish tone of the BoE, the pound has enjoyed a strong 24 hours. Sterling has climbed to a high of $1.27221 since the Bank’s latest decision was announced, the highest GBP has been against the dollar in over three months.

Although the stronger pound has slightly reduced gold and silver’s gains both metals have still benefitted from the weaker dollar. Gold has risen 1.7% in less than 24 hours and is currently just holding onto £1,600 per ounce. Silver gained 5.5% in the same period, climbing from £17.99 to pass £19 per ounce.

With the UK economy showing increasing signs of weakness, the Bank could perhaps be acting more hawkish than necessary, while the strength of the US economy could leave the Fed looking too optimistic. Despite markets winding down for the holidays, it won’t be too long to wait for the next rate decisions, which will only become increasingly important for gold and silver as anticipation builds for the first rate cut. The Fed will make their next announcement on January 31st with the BoE following suit on February 1st.

Having set a short-lived but significant new record less than two weeks ago, gold is still seeing historically high levels, and rate cuts resulting in a weaker dollar will only be to gold’s benefit. Whether gold can surpass the $2,200 needed for a new all-time high remains to be seen, but all the pieces are there as 2024 progresses.